The semiconductor sector has seen significant volatility over the past few years, driven largely by global demand, supply chain complexities, and emerging technologies like artificial intelligence (AI). The recent announcement from Hon Hai Precision Industry, better known as Foxconn, has generated a wave of optimism within the industry. With the company reporting record fourth-quarter earnings, it has sparked discussions about the broader implications for technology companies and the semiconductor market.

On a recent Sunday, Foxconn announced a staggering fourth-quarter revenue of 2.1 trillion New Taiwan dollars, equivalent to approximately $63.9 billion. This marks a remarkable 15% increase year-over-year, underscoring a robust recovery from pandemic-induced setbacks. Notably, this revenue figure represents the highest quarterly earnings in Foxconn’s history, signaling a turnaround in the company’s fortunes.

As a crucial supplier for tech giants like Apple, Foxconn’s success can be largely attributed to the accelerating demands for cloud computing and networking products, which incorporate AI-driven servers largely influenced by semiconductor giants like Nvidia. This shift towards cloud infrastructure and AI innovations suggests that Foxconn is capitalizing on trends that are not only transient but likely to spur sustained growth in the coming years.

Reactions Across Semiconductor Markets

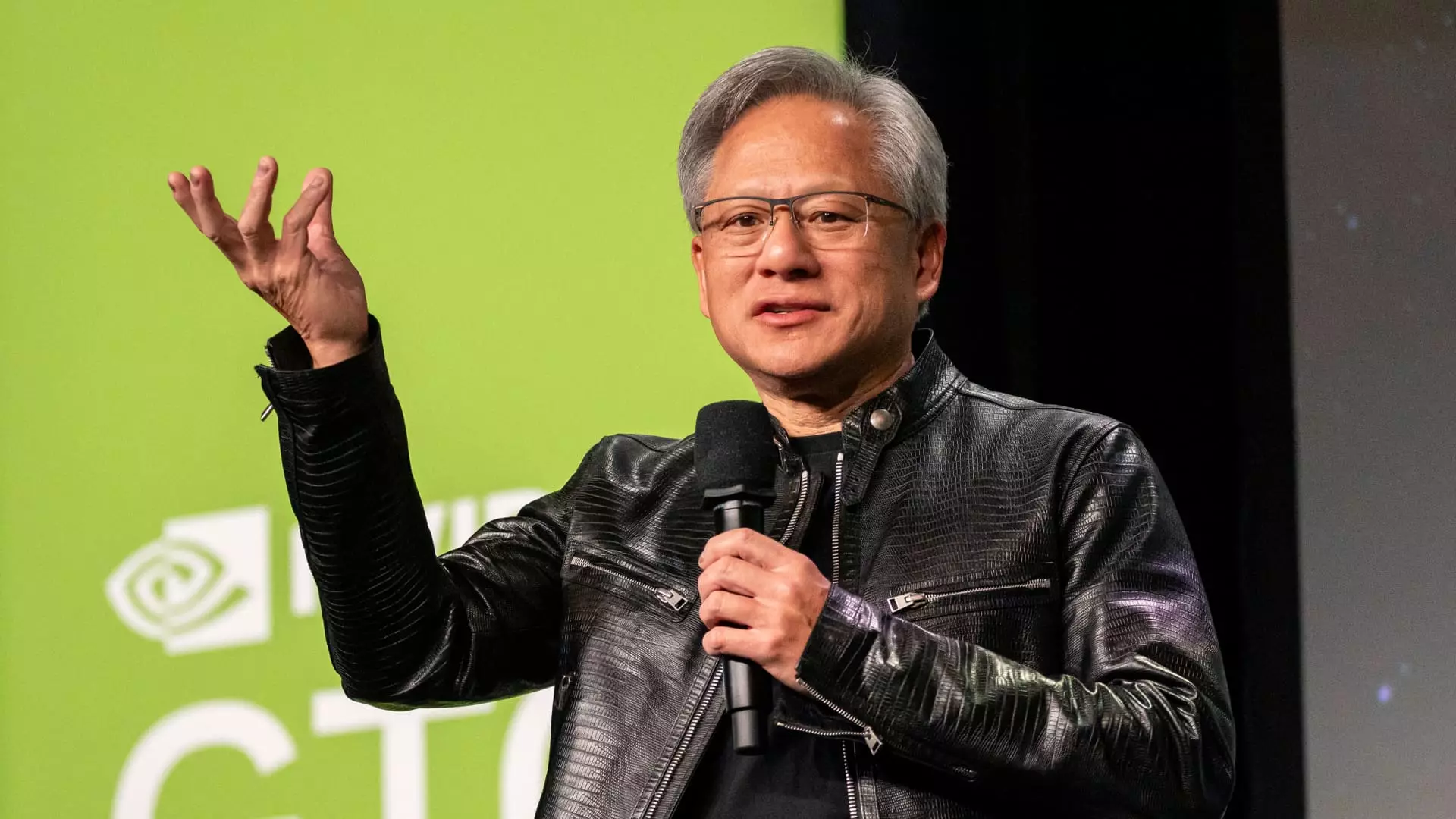

The announcement of Foxconn’s record earnings sent ripples through global semiconductor stocks, lifting share prices of numerous companies across Asia, Europe, and the United States. For instance, shares of Nvidia rose over 3% in response to Foxconn’s remarkable performance. Jensen Huang, CEO of Nvidia, is anticipated to address trendy topics at the upcoming Consumer Electronics Show (CES) 2025, further drawing attention to the growing relevance of AI in tech.

Furthermore, Microsoft’s recent decision to invest a massive $80 billion towards enhancing data centers designed to handle AI workloads has also fueled optimism in the semiconductor space. This significant financial commitment from one of the world’s largest technology companies signals a clear shift in focus towards AI technologies, encouraging investors and other tech firms alike to ramp up their GPU procurement.

AMD, a key competitor to Nvidia, likewise experienced a share price increase of over 3%, establishing that the positive sentiment surrounding Foxconn’s performance extends beyond any single manufacturer. Meanwhile, major U.S. chip-makers Qualcomm and Broadcom showcased modest gains as well, demonstrating the interconnected nature of the semiconductor market.

Regional Market Highlights: Asia’s Gains

In Asia, companies such as Taiwan Semiconductor Manufacturing Co. (TSMC) saw their stock prices climb nearly 5% following the announcement. As the largest semiconductor manufacturer globally, TSMC plays a pivotal role in producing chips for many leading firms, such as AMD and Nvidia. The growth in market share across Asian firms serves as a testament to regional dominance in semiconductor production.

South Korea’s SK Hynix and Samsung also benefited from this bullish trend, with respective share price increases near 10% and 4%. The international semiconductor landscape’s resilience is further proved by remarkable surges in European companies as well, with ASML and ASMI seeing gains of 8.7% and 6.2% respectively, and Germany’s Infineon surging nearly 7%. Such gains emphasize the broader significance of Foxconn’s achievements as they reverberate through the global supply chain.

The colossal revenue posted by Foxconn is a crucial indicator of the enduring demand for semiconductor technology, particularly in light of growing AI applications and data processing requirements. As tech giants pivot towards AI, investing heavily in GPUs and related technology, the semiconductor sector is poised not just for recovery but for sustained long-term growth.

Analysts predict that the increasing reliance on cloud-based services and machine learning innovations will create a steady demand for semiconductor products, enabling companies to further invest in cutting-edge technology and infrastructure. As this transformational wave continues to reshape the industry, stakeholders and investors will be vigilant, looking for further indicators that can sustain this positive momentum in global semiconductor stocks.

Foxconn’s robust quarterly performance exemplifies not just its own strategic timing but the broader trajectory of the technology landscape interconnected through semiconductor advancements, thereby painting an optimistic picture for the future of the industry.