In a move signaling significant upheaval within the Consumer Financial Protection Bureau (CFPB), employees were instructed to transition to remote work due to the closure of the agency’s Washington, D.C., headquarters until February 14. A memo from Chief Operating Officer Adam Martinez highlighted the agency’s current predicament, indicating an unsettling environment for employees. This directive follows a similar notice from acting CFPB director Russell Vought, who emphasized the suspension of nearly all regulatory activities, including the oversight of financial institutions.

The abrupt suspension of regulatory functions raises critical questions about the future of the CFPB. Established to protect consumers in the financial sector, the bureau’s diminished capacity to supervise financial firms is alarming. In recent years, the CFPB has faced scrutiny concerning its effectiveness and role in maintaining accountability within the financial services industry. The halt in operations not only undermines regulatory oversight but also places significant stress on CFPB employees, who may feel insecure in their roles during this troubling transition.

Adding to the chaos is the reported involvement of operatives from Elon Musk’s DOGE, who allegedly gained access to sensitive CFPB data, including employee performance reviews. Such encroachments on the bureau’s autonomy raise concerns about privacy and the integrity of internal operations. Musk, a vocal critic of the CFPB, previously advocated for its disbandment, and his social media posts, such as “CFPB RIP,” suggest a coordinated effort to undermine the agency’s effectiveness. This interplay of political and corporate interests significantly complicates the CFPB’s mission and future endeavors.

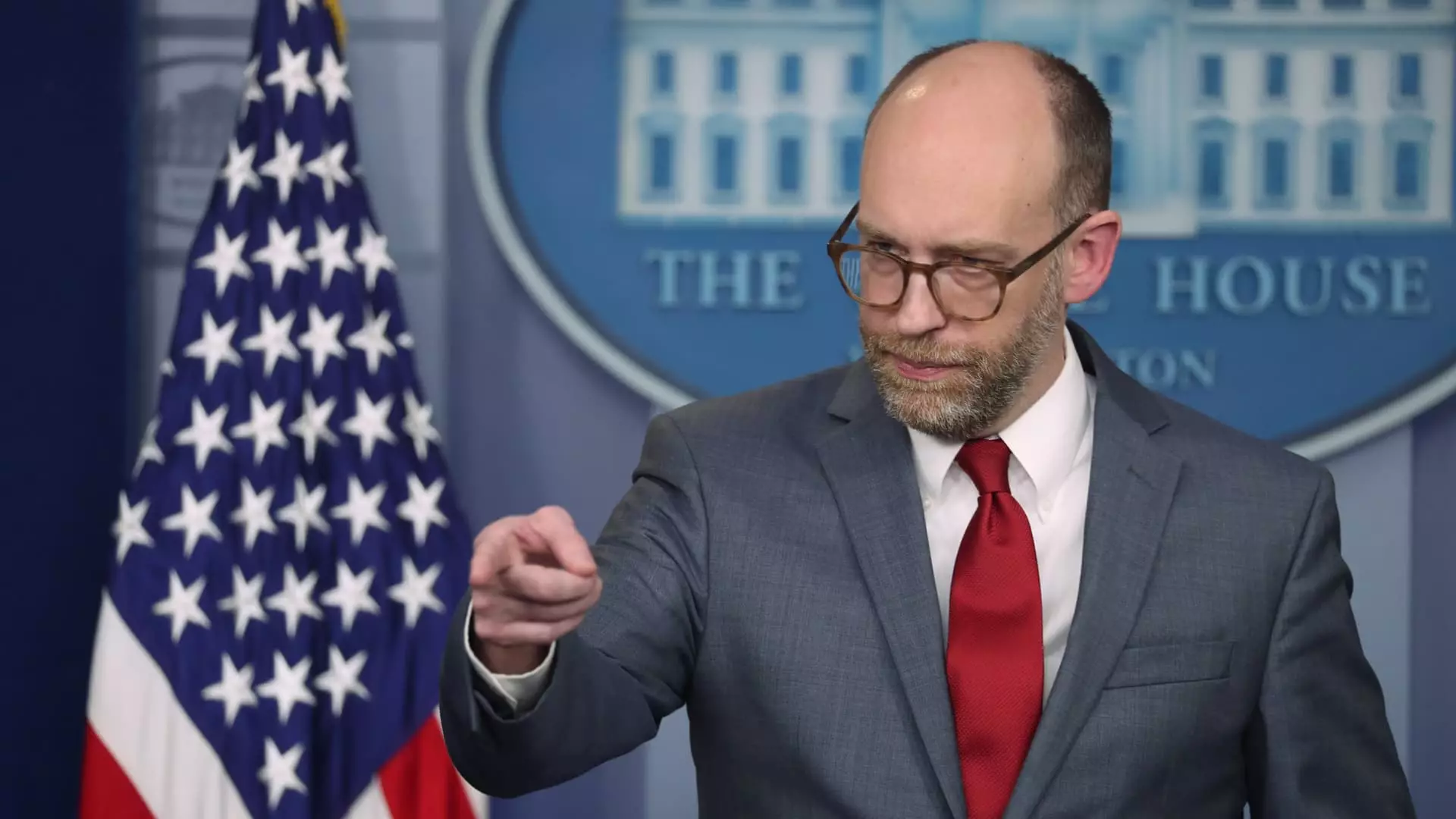

Vought’s recent statements underscore a broader ideological shift within the CFPB, with the new leadership appearing to align with longstanding calls for reducing the agency’s influence. His announcement regarding the cessation of funding marked a pivotal moment, creating an additional layer of uncertainty for both staff and the consumers who rely on the bureau’s protections. Such budgetary constraints, linked to a larger agenda represented by Project 2025, could potentially halt critical consumer protection initiatives at a time when financial literacy and accountability are needed most.

For CFPB employees, this tumultuous period raises pressing concerns about job security, workplace morale, and the overall direction of the agency. As they navigate the realities of remote work and heightened surveillance, employees might feel isolated and unsupported. The lack of clarity from leadership about the agency’s future amplifies uncertainties surrounding their roles in protecting consumers. Moving forward, it is crucial for both internal stakeholders and the broader market to seek clarity on the CFPB’s objectives, ensuring that the voice of consumer protection does not vanish amid political power struggles and funding cuts.

The CFPB faces an existential crisis exacerbated by leadership changes and external influences. The long-term impact on consumer protection remains to be seen, but continuous vigilance and advocacy will be necessary to uphold the agency’s foundational mission amidst evolving challenges.