In an unexpected twist of events, Nvidia, once a proud member of the illustrious $3 trillion market cap club, has recently tumbled from its lofty heights, leaving Apple as the sole occupant of this exclusive circle. The volatility in Nvidia’s stock price, which saw a sharp decline of over 8% following their quarterly earnings report, underscores the tumultuous nature of today’s tech market. This downturn erased an astounding $273 billion in market capitalization, dropping Nvidia’s total value to approximately $2.94 trillion. The repercussions of Nvidia’s faltering shares were felt broadly, contributing to a 1.6% drop in the S&P 500 and a staggering 2.8% slump in the Nasdaq.

Throughout 2025, Nvidia shares have been under pressure, losing 10% of their value year-to-date. Investor concerns have coalesced around several key issues, including stringent export controls, rising tariffs, and the advent of more efficient AI models. These factors, combined with an overall slowing growth rate, have led to trepidation about Nvidia’s future performance. However, it’s important to recognize that despite this recent decline, the company’s market capitalization is still five times larger than it was just two years ago, a period that marked the inception of the generative AI boom.

Nvidia initially reached a $3 trillion valuation in June 2024, heralding its dominance in AI technology. Yet, recent events have prompted a reevaluation of its trajectory, calling into question whether Nvidia can maintain its high valuation amidst increasing competition and shifting market dynamics.

Despite the recent drawbacks, Nvidia’s latest financial report revealed some encouraging metrics that may signify resilience amidst adversity. The company reported a remarkable 78% increase in revenue compared to the previous year, achieving a total of $39.33 billion. Notably, the revenue generated from Nvidia’s data center solutions, which are pivotal for AI workloads, skyrocketed by 93% to nearly $36 billion. This segment underpins the company’s financial stability, illustrating the robust demand for its cutting-edge graphics processors.

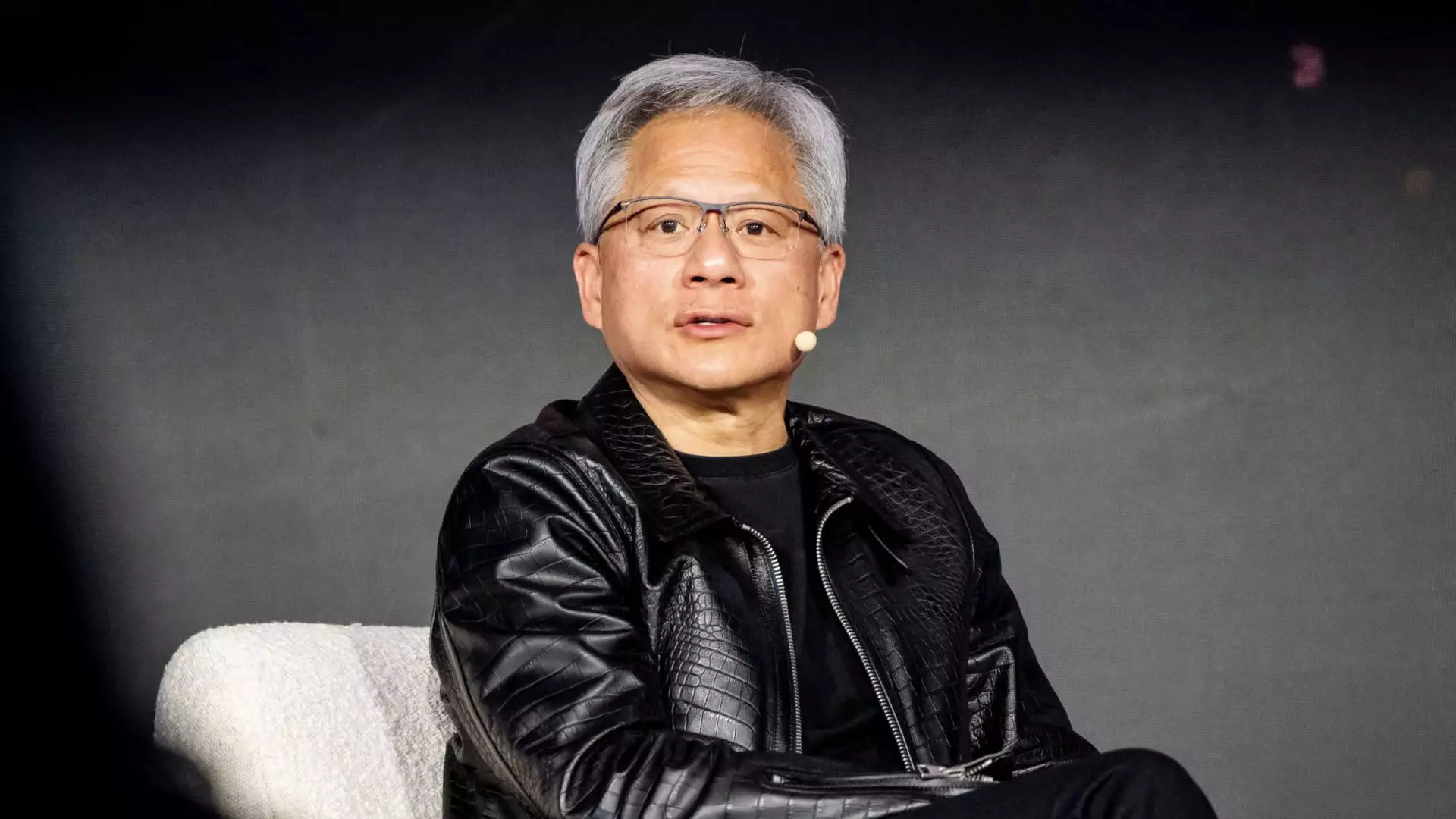

Nvidia CEO Jensen Huang remains optimistic, asserting that the anticipated demand for their next-generation chips—specifically the Blackwell series—has mostly overcome production challenges. In a recent interview, Huang emphasized the monumental shift in computational requirements for future AI models, suggesting that the complexity of reasoning tasks will necessitate an unprecedented increase in processing power.

A critical factor for Nvidia’s sustained success is its reliance on substantial infrastructure investments from leading tech companies such as Microsoft, Google, and Amazon. These titans of the tech industry account for roughly half of Nvidia’s data center revenue, illustrating the company’s intertwined fate with the fortunes of other tech giants. As these cloud service providers continue to expand their offerings and capabilities, Nvidia stands to benefit significantly, provided it can navigate the challenges in its path.

While Nvidia’s recent performance may suggest a period of uncertainty, the company’s foundational strength in AI technology and its critical partnerships provide a glimmer of hope for investors. The future trajectory of Nvidia will undoubtedly depend on its ability to adapt and innovate amid a rapidly evolving tech landscape.