In a stormy week for American equities, Warren Buffett’s Berkshire Hathaway has emerged resilient, outshining the broader market’s plummet. This resilience underscores a deep-rooted trust in Buffett’s strategy, especially during turbulent times propelled by unpredictable political maneuvers such as President Donald Trump’s aggressive tariff policies. While Berkshire’s Class B shares did fall by 6.2%, this decline pales in comparison to the broader market’s 9.1% drop in the S&P 500 and a staggering 10% nosedive in the tech-heavy Nasdaq Composite. When fear grips the market, having a safety net like Berkshire Hathaway—which operates diverse businesses from insurance to energy—can provide a certain level of assurance for investors seeking refuge.

Berkshire’s Unique Standing

What sets Berkshire apart from its large-cap peers is not just its diverse portfolio but also its robust cash position, amounting to an impressive $334 billion at the close of 2024. This liquidity positions them superbly amidst economic uncertainty; investors can find solace in knowing there’s real capital backing their shares. Interestingly, Berkshire is the only one among the top ten S&P 500 companies still trading above its 200-day moving average. For technical analysts like Rich Ross of Evercore ISI, this is no trivial achievement—it signifies a momentum that others simply do not possess. As uncertainty looms large, which companies are insulated against the market whims constantly influenced by governmental policies?

Trump’s Trade War: A Double-Edged Sword

The onset of the trade war has undeniably shaken the economic landscape, creating a chilling effect across sectors. The Dow Jones Industrial Average’s unprecedented back-to-back loss of over 1,500 points reflects the panic and instability permeating the market. However, while many companies scramble to stabilize themselves during this chaos, Berkshire Hathaway stands as an emblem of stability. Investors, recognizing which businesses can thrive regardless of Trump’s capricious decisions, are increasingly gravitating towards Berkshire as a defensive play. Josh Brown, CEO of Ritholtz Wealth Management, succinctly highlighted Buffett’s company’s unique positioning: it doesn’t rely on the whims of Washington or the shifts in global economic tides to structure its strategy.

Seeking Safety in Uncertain Times

As markets oscillate wildly, Buffett’s approach remains notably steadfast. The massive cash reserves allow Berkshire to weather downturns and seize opportunities when they arise—traits that are increasingly prized in an environment where volatility reigns supreme. The conglomerate’s diverse holdings—encompassing everything from insurance to energy—buffer it against sector-specific downturns. Thus, despite a terrestrial backdrop riddled with uncertainty, Berkshire Hathaway stands tall, inviting investors to embrace a blend of safety and growth potential.

The Myth of Dependency on Politics

Investors are becoming increasingly aware that not all companies are tethered to the political leash, and it’s vital to differentiate between entities that invoke real economic value and those that are merely riding the coattails of policy decisions. As markets react emotionally to presidential proclamations, companies like Berkshire become a compass for navigators seeking stability in tumultuous waters. The insight from Brown that Berkshire “does not have to go hand in hand with the White House” reveals a growing recognition amongst investors. In times where governmental unpredictability can wreak havoc on share prices, Buffett’s firm distinctly separates itself through a focus on sustainable practices rather than transient political whims.

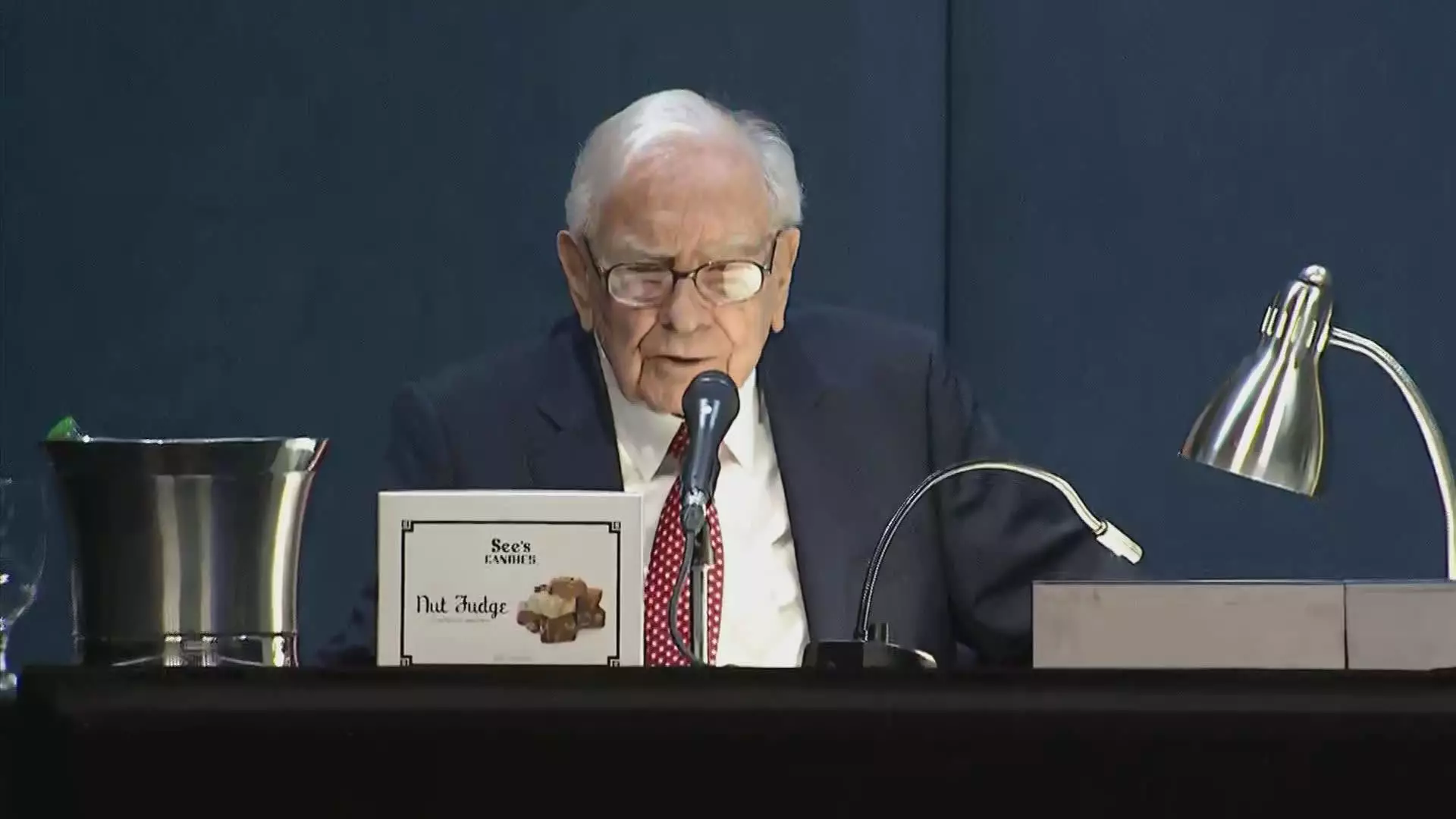

Buffett’s Confounding Silence

Adding an element of intrigue, Buffett’s recent denial of social media remarks allegedly attributed to him showcases a commitment to maintaining the sanctity of his public persona amidst rising political tensions. The intertwining of social media rhetoric and market dynamics exemplifies the bizarre nature of contemporary investing landscapes—a landscape where misinformation can shatter trust as quickly as solid strategies can build it. When someone of Buffett’s stature refutes claims tied to a sociopolitical context, it sends ripples through the financial community, leaving investors to ponder: just how deeply intertwined should their portfolios be with the shifting currents of Washington? The broader implications resonate beyond Buffett alone; they question the very foundation of how investment strategies are constructed in an era defined by volatility and uncertainty.