The ongoing tussle between Nippon Steel and U.S. Steel, culminating in a proposed $14.9 billion acquisition, has sparked significant discourse around national security, economic implications, and international relations. The Biden administration’s decision to delay the order requiring Nippon Steel to withdraw from the deal until June 2025 introduces an extended window for negotiations and potential legal examination. As these companies grapple with the government’s stance, the larger implications for both the U.S. steel industry and Japan-U.S. relations remain paramount.

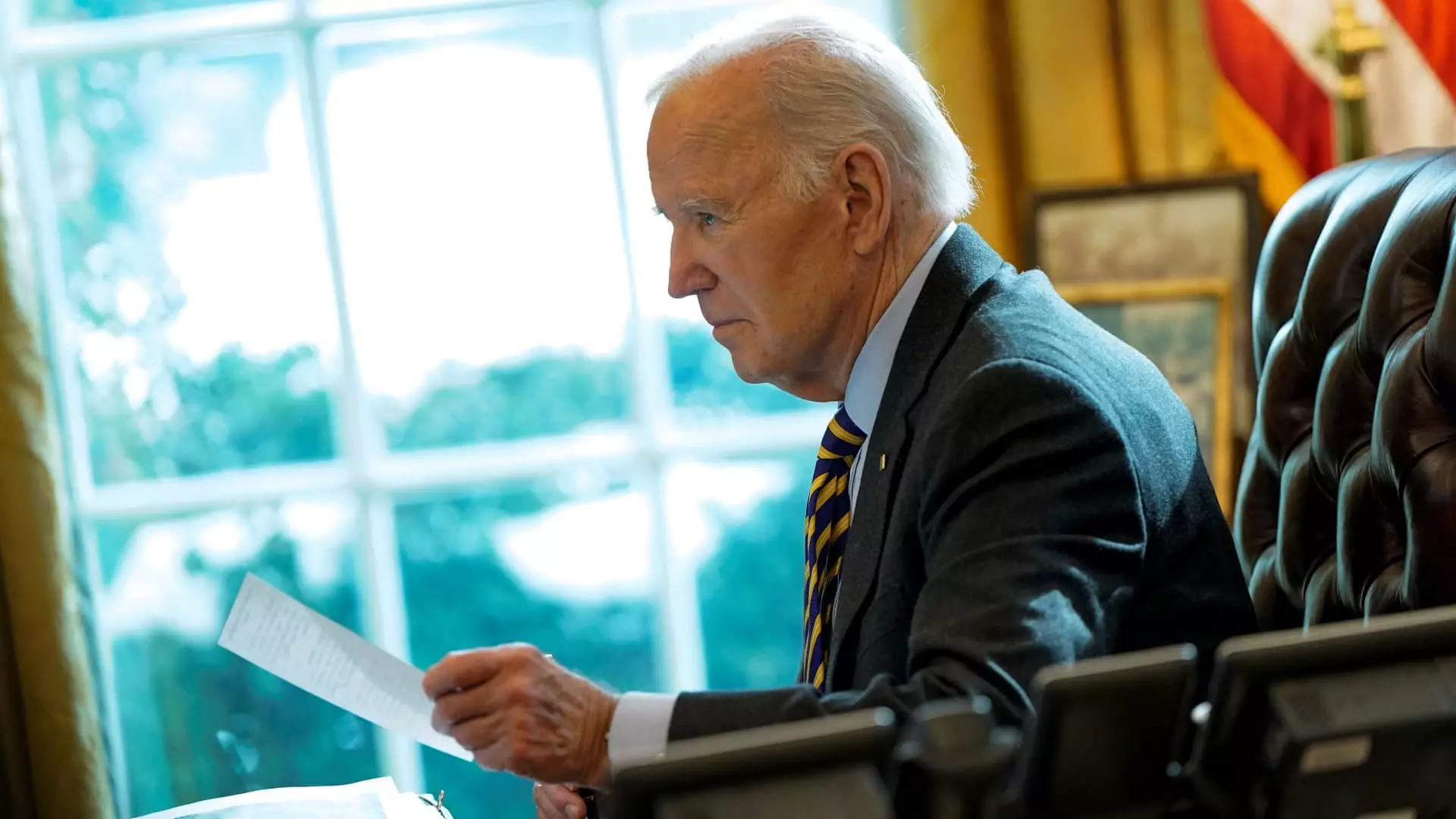

President Biden’s administration grounded its initial blockage of the acquisition in national security concerns. This rationale mirrors a broader strategy aimed at scrutinizing foreign investments, particularly those that could impact critical sectors within the U.S. economy. Treasury Secretary Janet Yellen confirmed that the Committee on Foreign Investment in the United States (CFIUS) conducted a thorough review of the proposed acquisition. By extending this timeline, the administration has opened the door for not just a potential legal reevaluation, but also for a broader discussion on the future of U.S. manufacturing amidst global competition.

This underpinning of national security is critical in the context of increased geopolitical tensions, where energy independence and economic resilience are central concerns for policymakers. The U.S. government’s approach indicates a protective stance toward domestic asset security, particularly in sectors pivotal to national infrastructure and defense.

In their ongoing legal battle, Nippon Steel and U.S. Steel have argued that the CFIUS review process was unduly swayed by President Biden’s personal aversion to the merger. They claim a right to a fair evaluation absent prior bias, presenting their case to a federal appeals court to enable a fresh review of their proposed acquisition. This highlights a litigious response typical of large corporations operating in highly scrutinized environments—where challenging regulatory decisions through judicial avenues becomes a viable strategy.

The companies’ public statement expressing optimism about the extended deadline signals their intent to pursue the acquisition vigorously, underscoring their belief that such a deal would benefit not just their clients, but the broader American steel industry. Their ongoing commitment also reflects a strategy underpinned by significant financial investment, projecting confidence amid uncertainty.

The resistance from the United Steelworkers union is an essential aspect of this saga. Unions often wield considerable influence in political landscapes, particularly in manufacturing sectors like steel, where worker interests are directly aligned with economic policies. Their opposition to Nippon’s acquisition raises questions about job security and the commitment to preserving domestic manufacturing jobs, which is a hot-button issue for many American voters.

The political dimensions of this standoff are further complicated by the historical context, as both Biden and former President Trump have expressed opposition to the deal amid electoral campaigns aimed at securing union votes. This bipartisan apprehension reflects an understanding that labor sentiment is crucial for political capital in many American constituencies.

The diplomatic fallout of these proceedings cannot be overlooked, especially considering Japan’s position as a major investor in the U.S. economy. Japanese Foreign Minister Takeshi Iwaya articulated significant concerns over Biden’s decision, marking it as “highly regrettable.” He emphasized that the transaction’s handling is vital for sustaining the broader U.S.-Japan alliance, which has long stood as a cornerstone for stability in the Asia-Pacific region.

As Iwaya noted, the unease felt within the Japanese business community is reflective of larger anxieties regarding the evolving nature of trade relations. The risk of perceived isolationism or protectionism could disrupt other investments and partnerships, posing a deeper challenge to U.S. economic strategy.

As the clock ticks toward the June 2025 deadline, both Nippon Steel and U.S. Steel must navigate a complex landscape of legal battles, political pressures, and international diplomacy. The outcome of this case holds the potential to reshape not only the companies involved but also the contours of U.S. industrial policy and foreign investment practices. How this situation unfolds will be closely watched, as it could set pivotal precedents that resonate through the steel industry and beyond, influencing the future trajectory of American manufacturing and international relations.