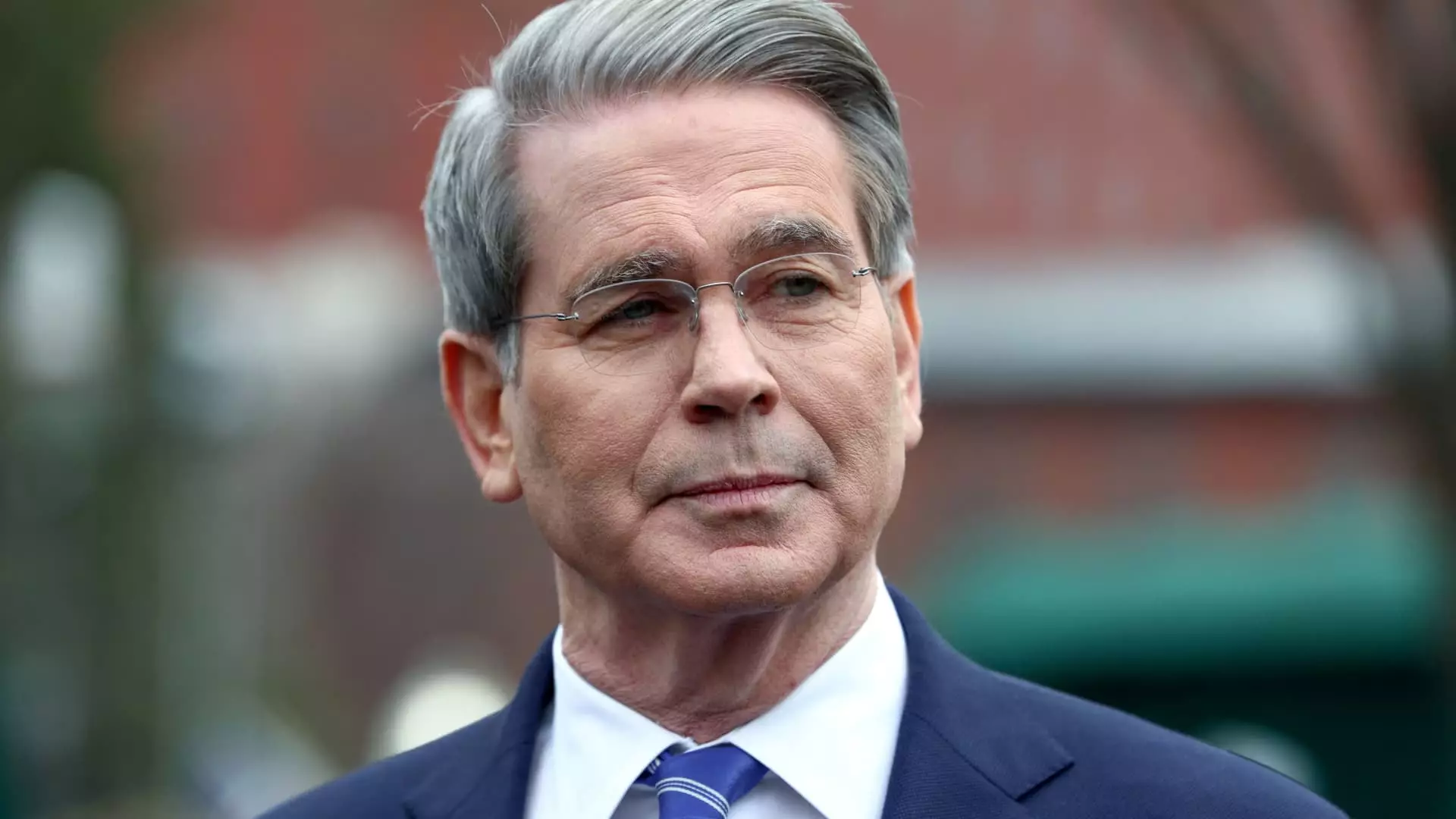

In a recent appearance on NBC’s “Meet the Press,” Treasury Secretary Scott Bessent attempted to soothe anxieties regarding a potential recession and the financial well-being of American retirees. His assertions drew a stark divide between reality and the narrative he perpetuated, claiming that President Donald Trump’s administration is crafting a solid foundation for economic prosperity. Yet, his disregard for the immediate concerns of everyday Americans grappling with their savings is nothing short of alarming.

Bessent’s reliance on a long-term perspective is not just overly simplistic; it is dangerously dismissive. He described fears about retirement savings dwindling due to market fluctuations as a “false narrative.” This phrase speaks to a persistent issue within the corridors of power: the tendency to undermine genuine public concern and reduce it to mere narrative manipulation. While it is true that the stock market can exhibit resilience over the long term, the veritable nosedive it experienced post-Trump’s tariff announcements indicates an unsettling trend; the very stability Bessent claims to support is tenuous at best.

Ignoring the Signs of Turmoil

One cannot ignore the stark realities highlighted by the significant losses in the Nasdaq, Dow Jones, and S&P 500 following Trump’s announcement of steep tariffs on major trading partners. Bessent’s assertion that the market consistently underestimates the President is more hollow than hopeful. While rhetoric can be used to placate the public, it fails to address the economic instability that is palpably affecting Americans. Underestimating the market’s reaction simplifies a complex issue; it implies a lack of accountability for national economic policy decisions.

In an era where millions are struggling to make ends meet, how can one be expected to adopt a long-term outlook when their immediate financial security feels threatened? Bessent’s statement that most Americans do not have “everything in the market” may be factually correct, but it misses the broader context: millions rely on their investments, no matter how modest, to secure a stable future. Suggesting that these concerns can be brushed aside negates the distress faced by retirees worried about their investments and savings.

Promises Amid Economic Undercurrents

Trump’s call to “hang tough” feels misplaced and out of touch. The pressure on consumers to endure economic hardship is a dangerous anecdote that echoes through history. The comparison to President Ronald Reagan’s tenure, where economic adjustments eventually bore fruit, fails to consider the unique challenges facing today’s economy, particularly the global pandemic’s ongoing effects. Bessent’s implication that history will repeat itself glosses over the substantial differences in the current economic landscape.

His reference to a “decades-long” unsustainable system of trade is both an acknowledgment of past mistakes and a plea not to hold the current administration accountable. It is easy to blame previous administrations for inherited issues; however, the question remains: how will this administration pivot from rhetoric to reality? Without concrete action and acknowledgment of the urgent need for reform, the narrative being spun feels more like denial than a strategy.

A Call for Realism and Accountability

Ultimately, what lies beneath Bessent’s optimistic projections is a troubling disconnect between leadership and the lived realities of American citizens. When market shifts undercut the financial viability of retirement plans, it is the responsibility of leaders to address these fears with compassion and realism rather than dismissive platitudes.

The U.S. economy is not merely a collection of statistics and charts; it is the lifeblood of its people. If Bessent and the Trump administration wish to fortify their legacy, they must move beyond the “economic revolution” rhetoric and engage in genuine dialogue with the American public. Economic stability and prosperity cannot be achieved merely through optimistic projections; they require hard work, accountability, and a commitment to addressing the pressing needs of all citizens, not just the privileged few.

In withholding acknowledgment of legitimate concerns, Bessent risks alienating a populace that has reason to be wary. The challenge lies in bridging the gap between perceived economic resilience and the stark reality of financial insecurity faced by countless Americans. The façade of stability may hold for a time, but the underlying fractures of trust and accountability risk collapsing the edifice of economic optimism that is so often portrayed.