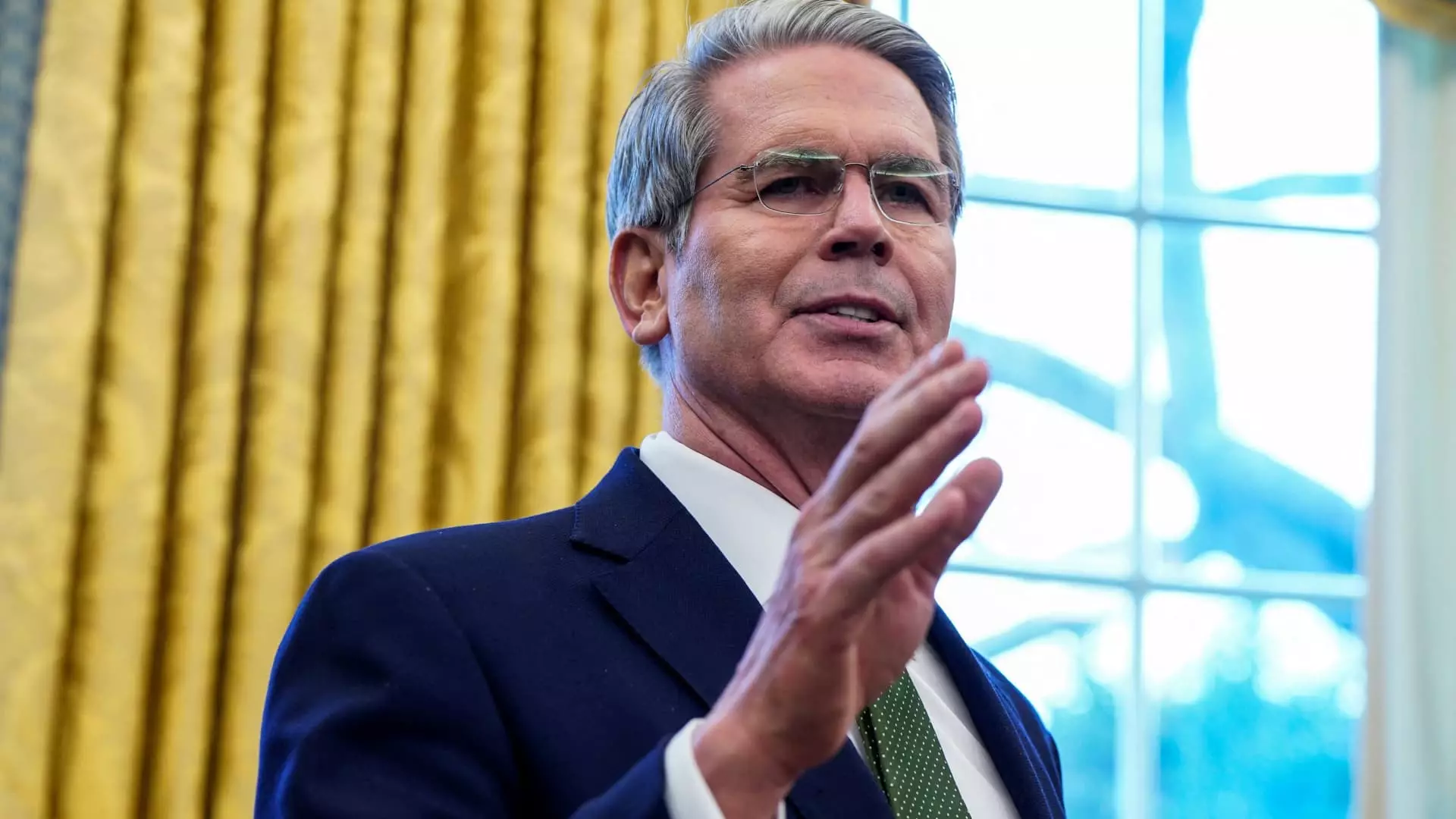

The economic landscape under the Trump administration has evolved significantly, particularly in the way it interacts with the Treasury yields and the Federal Reserve. Unlike past practices where Trump voiced strong opinions regarding the Federal Reserve’s monetary policies, Treasury Secretary Scott Bessent has clarified a distinct pivot. The administration’s current focus is primarily on maintaining low Treasury yields, particularly the 10-year Treasury bond, as opposed to simply advocating for cuts in the federal funds rate. This strategic shift raises questions about the overall economic implications and priorities of the Trump administration.

Bessent’s recent statements emphasize that the Trump administration is more concerned with the performance of the 10-year Treasury yield rather than the federal funds rate, a critical indicator of short-term interest rates influenced directly by the Fed. The rationale behind this focus is that lower long-term interest rates can stimulate economic growth by making borrowing cheaper for consumers and businesses—a key aspect of Trump’s economic philosophy. As Bessent articulated in a recent interview, “The president wants lower rates,” indicating a strategic view that prioritizes the sustainability of economic growth through favorable borrowing conditions.

Historically, the federal funds rate has held significant sway over various lending rates, including those for mortgages and consumer credit. However, recent patterns have illustrated that lower federal funds rates do not always correlate with declining Treasury yields. For instance, following a rate-cutting cycle initiated by the Federal Reserve starting in September 2024, Treasury yields exhibited an unexpected rise. This situation underscores a complex relationship between monetary policy and market behaviors, suggesting that a simplistic approach to economic policy might overlook the factors at play.

Bessent outlined key components of the administration’s economic strategy, which includes deregulation, tax reforms, and energy policies aimed at bolstering growth. The administration’s ambition to secure the permanence of the Tax Cuts and Jobs Act reflects a long-term commitment to fostering a business-friendly environment. The expectation is that stimulating the economy through deregulation and tax incentives will naturally lead to lower rates and a stronger dollar without necessitating active measures taken by the Federal Reserve.

The commitment to energy exploration speaks to a broader strategy that seeks to amplify domestic production and reduce reliance on foreign energy sources. This could elevate economic stability, thereby influencing long-term Treasury yields favorably. As Bessent noted, “if we deregulate the economy, if we get this tax bill done, if we get energy down, then rates will take care of themselves.” This perspective suggests a belief in self-correcting mechanisms within the economy, which may or may not hold true in practice.

Market analysts like Krishna Guha from Evercore ISI view these developments as a signal to monitor closely. Guha’s commentary on the importance of keeping the 10-year yield below the 5% threshold suggests that, should yields exceed this level, it could lead to adverse effects on equities and real estate—a situation termed “Trumponomics breaking down.” Currently, as yields hover around 4.45%, there exists a cautious optimism regarding the administration’s ability to maintain this balance.

The interplay between fiscal policy and market reactions will remain critical in assessing the administration’s success. Bessent’s assertion that Trump will not be aggressively pursuing Fed rate cuts as in his first term is noteworthy. With both the executive and the monetary authority recognizing the necessity for cooperation, there appears to be a tempered approach to economic growth amidst uncertainty.

The strategic focus of the Trump administration on Treasury yields reflects an evolving economic narrative that intertwines monetary and fiscal policies. With an emphasis on deregulation, tax cuts, and energy independence, the administration appears committed to a long-term vision that seeks to stimulate growth while maintaining low interest rates. However, the complexities of market dynamics and global economic factors will undoubtedly play a significant role in shaping outcomes. As this narrative unfolds, observers will need to closely monitor the interdependencies between Treasury yields and the broader economic indicators that define the health of the U.S. economy.