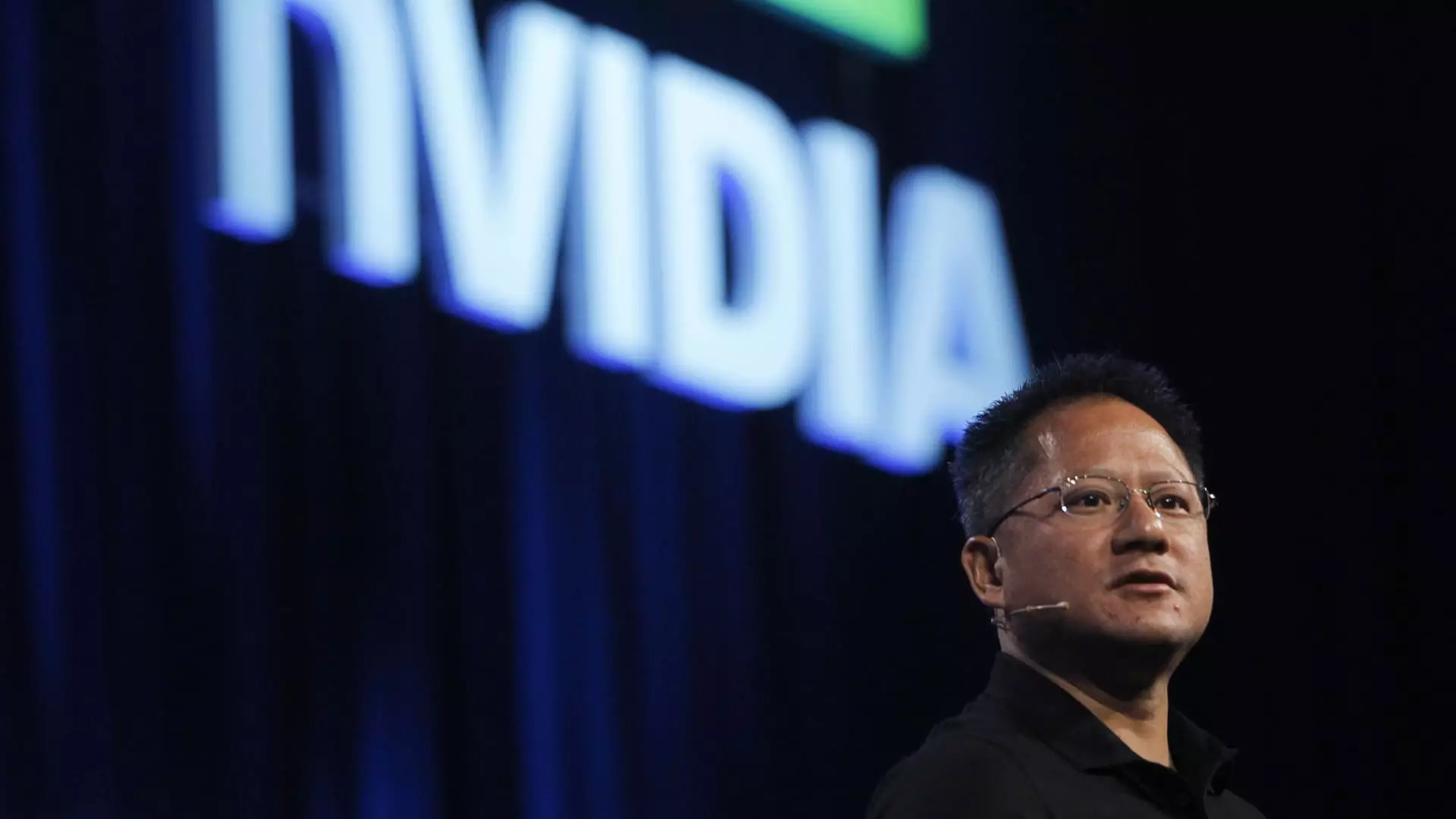

In the dynamic landscape of stock trading, few companies loom larger than tech behemoths like Nvidia and Amazon. These firms exemplify innovation, not only in their products and services but also in how they navigate complexities in the market. Bank of America is bullish on their prospects, presenting a strong case for their continued growth. With an increasing demand for artificial intelligence (AI) and automation, Nvidia stands as a trailblazer. Analysts suggest the company is poised for remarkable feats in the AI sector, underpinned by its early strides in technology, robust developer support, and a pipeline that appears to be overflowing with opportunities.

Nvidia’s capacity to leverage its advantages in AI technology places it in a favorable position. The company isn’t just riding the AI wave; it is actively shaping it. The exciting developments in machine learning and graphics processing demand a multifaceted approach, and Nvidia’s leadership in this sector suggests a grand forecast for investors. Their hands-on practices in developing AI-centered products are likely to yield significant returns, and it’s hard to ignore the growing sense of urgency for companies to adopt these solutions. Nvidia is not merely riding the tide; it’s creating the waves.

Amazon’s Robotic Revolution

Meanwhile, Amazon is also set to redefine efficiency and customer service through an ambitious adoption of robotics and advanced technologies. Dreamt up in a post-industrial age, Amazon is continuing to take strides into the future. The firm recently adjusted its price target, signaling optimism from analysts who recognize the vast potential for automation to not only enhance performance but also to solidify Amazon’s edge in the competitive landscape of e-commerce.

As robots whir through warehouses, sorting and dispatching their cargo with unparalleled precision, Amazon is cleverly using technology to bolster profit margins while improving delivery timelines. These efficiencies do not just streamline operations; they provide Amazon with a competitive moat, positioning the company as a formidable force amidst global retail competitors. In the world of e-commerce, being a step ahead in technology is not just an advantage — it’s a necessity. In a time where online shopping trends show no signs of abating, Amazon is flawlessly primed to capture expanding markets while pushing forward with innovations that ensure customer satisfaction.

Boot Barn’s Western Renaissance

Turning our gaze to Boot Barn, we enter a territory that may not immediately appear tech-inclined. Yet, this Western-themed footwear brand steps deftly into a market with abundant potential. Bank of America analysts have identified a cascade of positive indicators that could propel Boot Barn into a new echelon of performance. Its strategy to cater to a diverse array of merchandise categories across multiple geographical regions is not merely sound; it’s inspired. This broad-based appeal positions Boot Barn as a multi-year growth story — one that seems likely to manifest through sustained demand.

Moreover, with an appealing pricing environment and the company’s increasing scale, Boot Barn can leverage its brand, improve selections, and provide exceptional customer service. The decision to invest in a brand that is seemingly thriving while remaining relatively insulated from global pressures like tariffs demonstrates a savvy investor mindset. Boot Barn is not merely a retailer; it represents the convergence of lifestyle and commerce. As the demand for niche products rises, Boot Barn appears well-placed to harness new opportunities while sustaining momentum.

Netflix’s Unmatched Streaming Power

Now, let’s not forget about the streaming titan, Netflix. It’s astonishing how Netflix has retained its position at the forefront of entertainment, even amidst an ever-competitive landscape. The firm’s latest movements have left analysts optimistic about sustaining growth, both in terms of subscribers and earnings. The price target adjustments signal a positive sentiment, especially as Netflix embraces further avenues for expansion through advertising and unique content offerings.

With its unmatched scale, Netflix continues to redefine entertainment consumption. As viewership habits evolve, the company finds itself flexibly positioned to cater to new audience demands. The rising importance of sports and live events offers another dimension to their strategy — one that blends entertainment with real-time viewer engagement. As Netflix diversifies its offerings and scales its operations, the power it holds in the streaming sector is only set to strengthen.

Investors are not merely betting on a tech company but rather joining a cultural revolution that has transformed how we consume media. Netflix isn’t just a streaming service; it’s a central player in the modern consumer’s entertainment landscape. In an age where traditional viewing habits are in flux, Netflix emerges as an indispensable fixture, ready to leap into its next phase of growth and viewing innovation.

The potential seen in these companies reflects the broader trends in the market, showcasing the intersection of technology, consumer behaviors, and strategic foresight. The stocks mentioned are not just numbers on a chart; they represent a unique opportunity to invest in the success of innovative businesses reshaping their industries.